Our features

Take a peak at some of our features built to make your digital tax simpler.

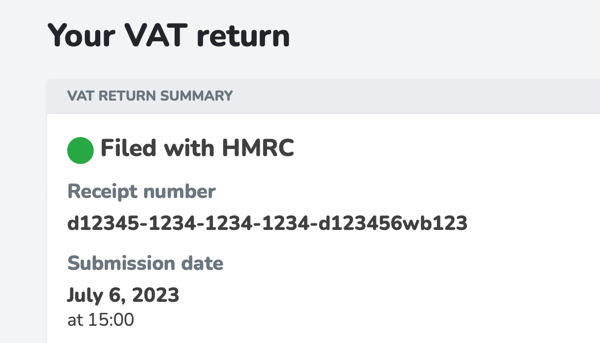

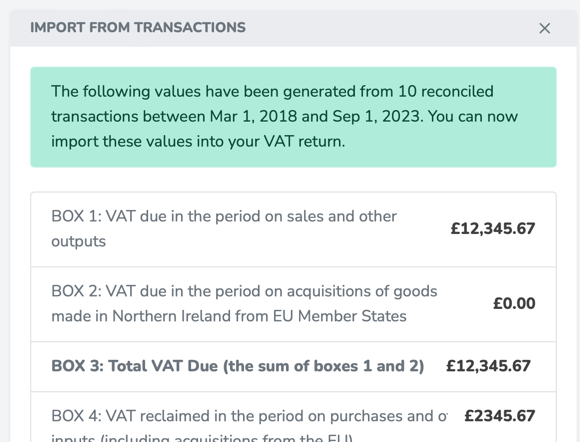

Submit your VAT return

We connect directly with HMRC to allow you to submit your VAT return and we are fully compliant with Making Tax Digital.

VAT

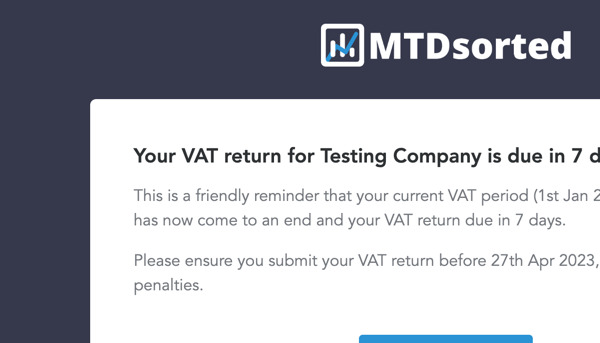

Get notified

Stay in the loop and never miss a deadline again, we'll always let you know when your tax returns are due and also give you a confirmation alert when you've submitted!

VAT

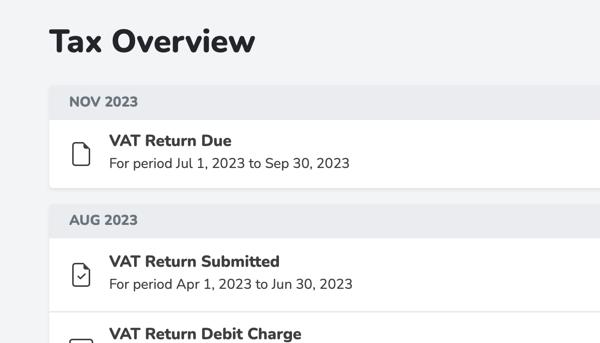

See your company tax overview

Understand the full picture and see exactly when payments are taken, how much your liabilities were and when your next VAT return is due.

VAT

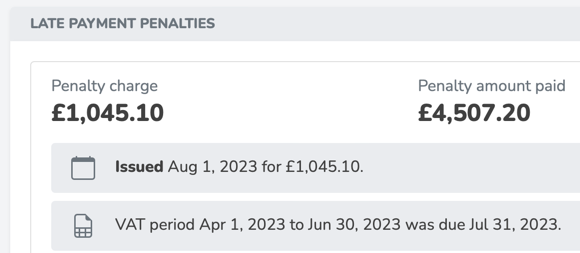

Track VAT penalties

See the status of any VAT penalties and track when they will expire.

VAT

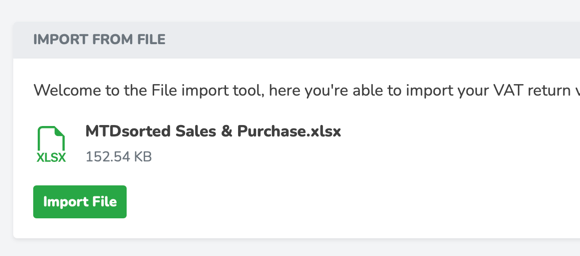

Import VAT from a file

Use your existing spreadsheet or CSV file to handle the calculations, then import to your return when you're ready to submit.

VAT

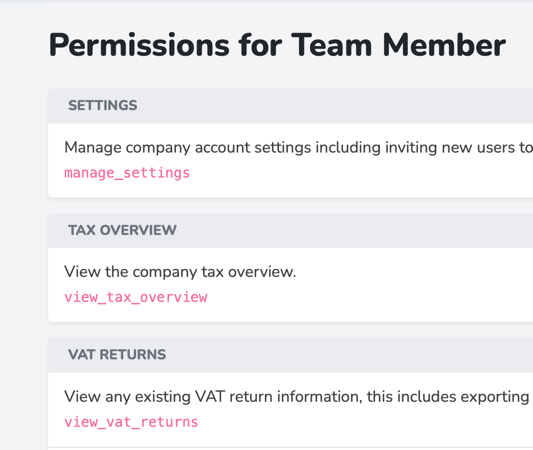

Advanced user permissions

Limit your team members access to specific areas of MTDsorted. Giving you peace of mind and complete control over who sees what private details.

Company Management

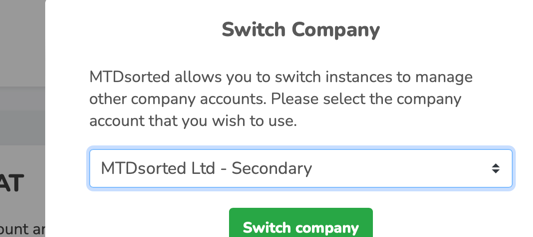

Manage multiple companies

Keep your records for multiple business entities, we keep each instance separate to ensure your data is not shared where it doesn't need to be.

Company Management

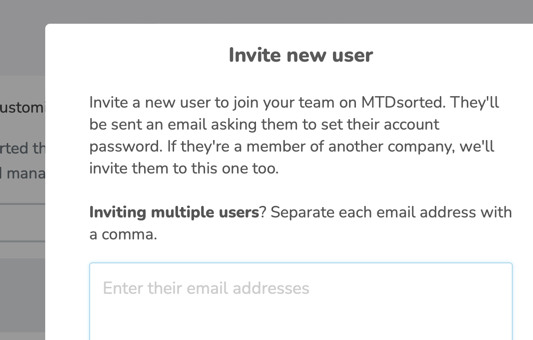

Invite your entire team

Share the workload and let everyone in your team build out your business books and customer lists.

Company Management

Manage merchants and customers

Keep track of your customers and get an overview of each customers spending with your business.

Books

We're always here to help

Should you have a question, need support or spot something not quite right, our team are here when you need us most.

MTDsorted

Automatically calculate your VAT

At the end of each period, take your sales and purchases from the period and use these to automatically calculate your VAT return.

Books

Connect to your bank accounts

Automatically import your spend directly from your UK bank account, Stripe or Paypal.

Books

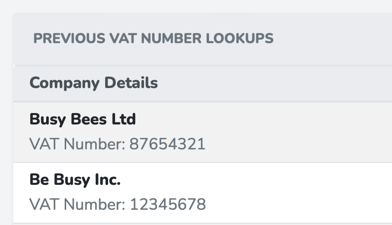

Search for a VAT number

Look up a business from their VAT number and get a search reference when you need it. We'll store each of your searches.

VAT

Digital transaction reporting

Keep a record of your business transactions, then filter down by month and date to get a full picture of your expenditure.

Books