How do I register my company for Making Tax Digital for VAT?

HMRC have made the process for joining the 'Making Tax Digital for VAT' scheme super simple.

Once you've signed up for Making Tax Digital, you can only use software to submit your VAT Returns.

Before you sign up..

To start, you'll need to have the following information to hand:

You'll need to have your Government Gateway account details to hand in order to sign up, if you don't already have an account, you'll be able to create one during this process.

You'll also need a 'Making Tax Digital for VAT' software package, this is where MTDsorted comes in. If you haven't already, you're able to sign up for our platform using the button below, and create your company account.

- Sole Trader:

- You'll also need your National Insurance number.

- Limited Company or Registered Society:

- You'll also need your company registration number and Unique Taxpayer Reference for Corporation Tax.

- Limited Partnership:

- You'll also need your company registration number, Unique Taxpayer Reference for Corporation tax and the postcode where you're registered for Self Assessment.

- General Partnership:

- You'll also need your partnerships Unique Taxpayer Reference and postcode where you're registered for Self Assessment.

Register your company on MTDsorted

Time to register..

Your next step is to head to the HMRC sign up page.

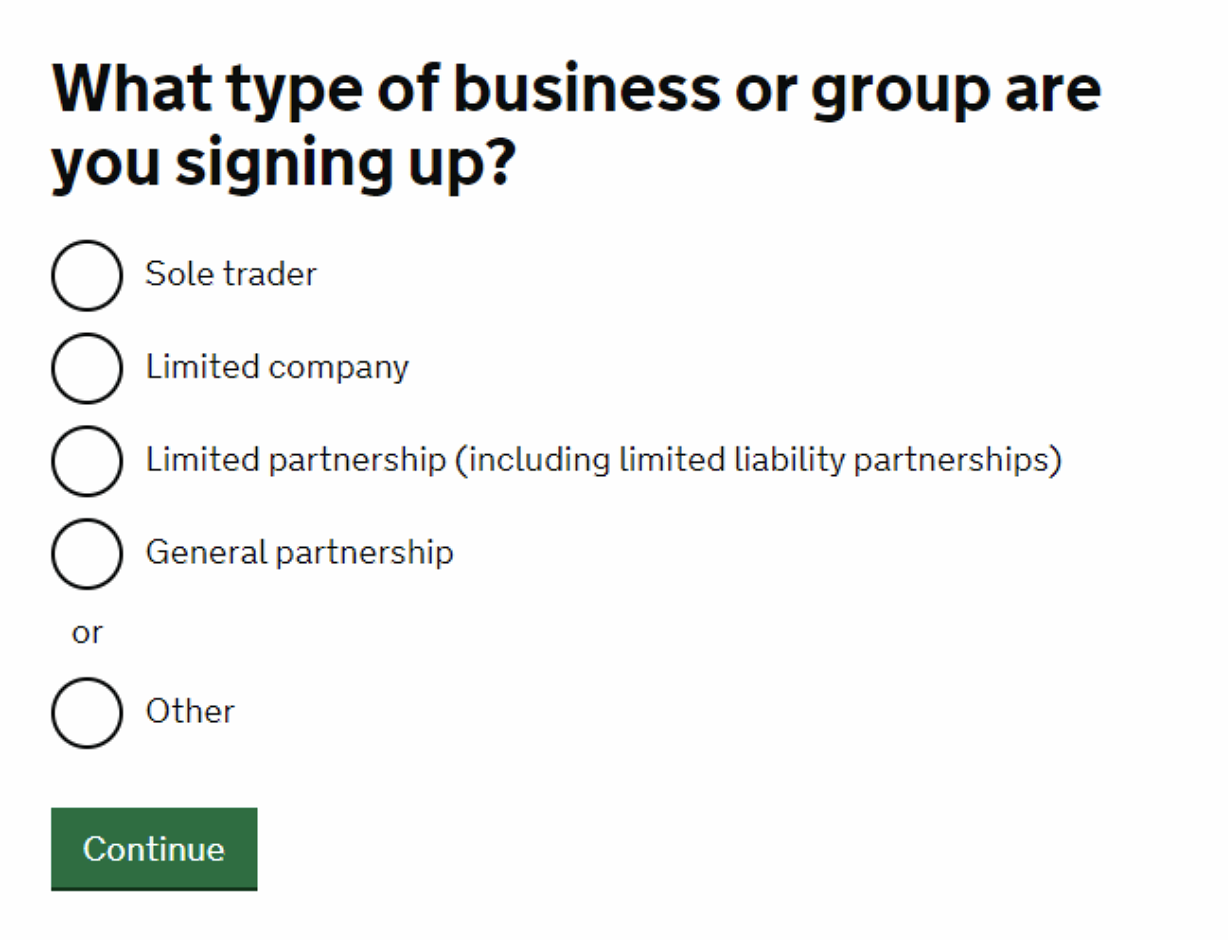

You'll need to answer a few questions for HMRC to correctly set up your account.

We've got a few screenshots below to guide you through the process.

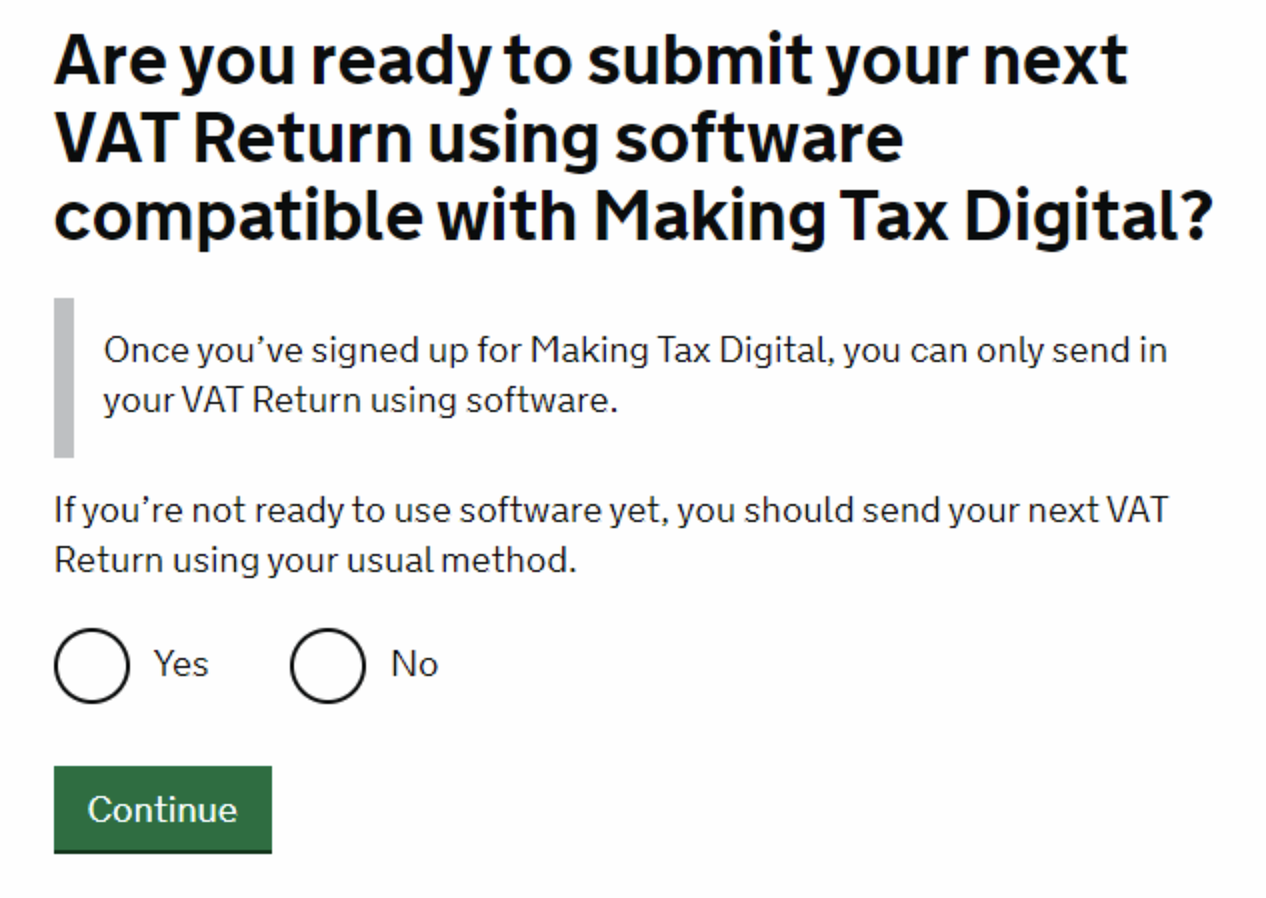

Are you ready to submit your VAT Return using software?

If you're all signed up to MTDsorted, we're able to take this on for you and get your VAT Return submitted. If this is the case or you use another software platform, click yes!

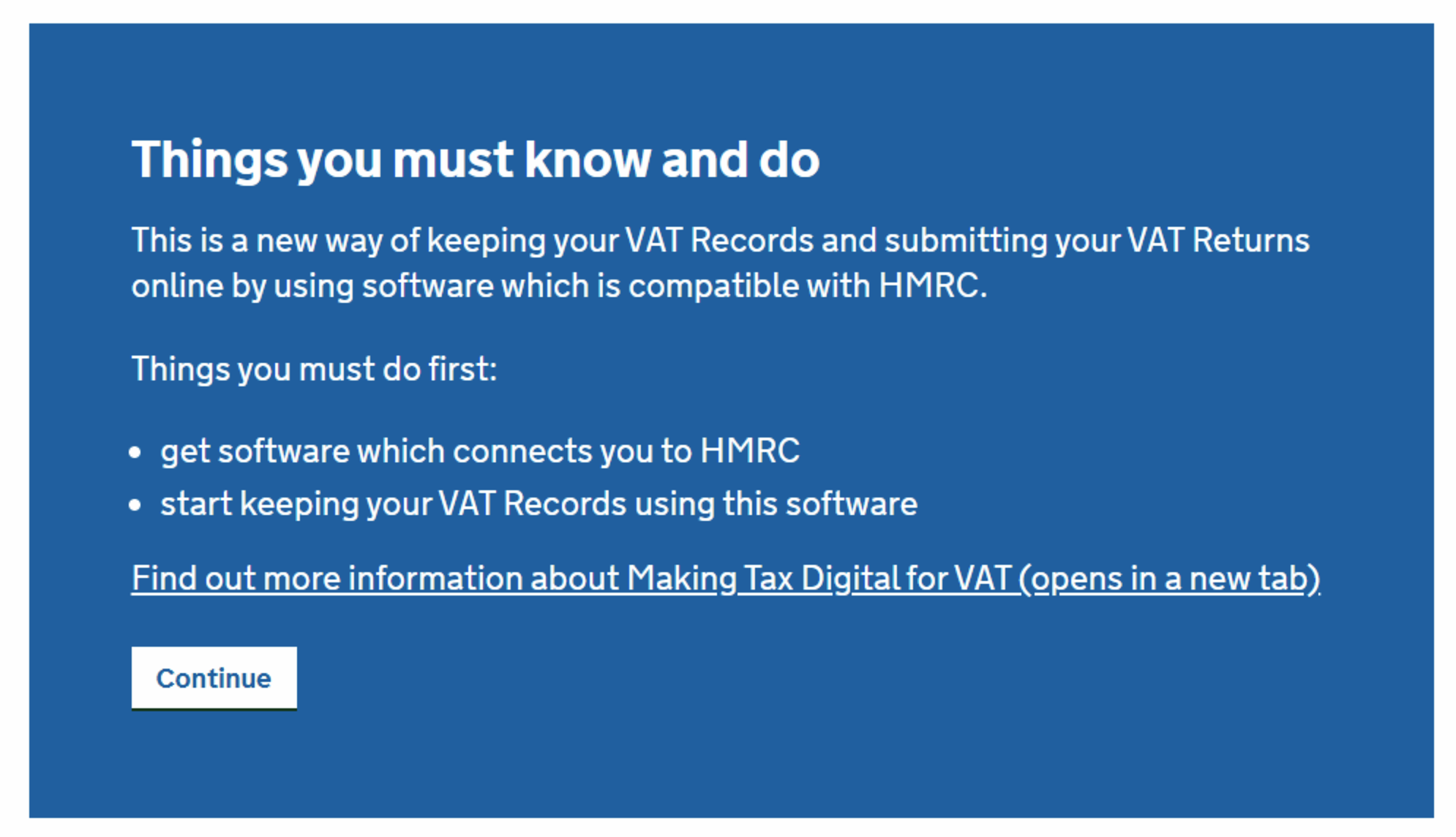

Confirm how you currently run your accounts.

You'll be asked a question about how you currently keep your VAT records, and to confirm that your software is compatible with Making Tax Digital. MTDsorted is fully 'Making Tax Digital' compliant!

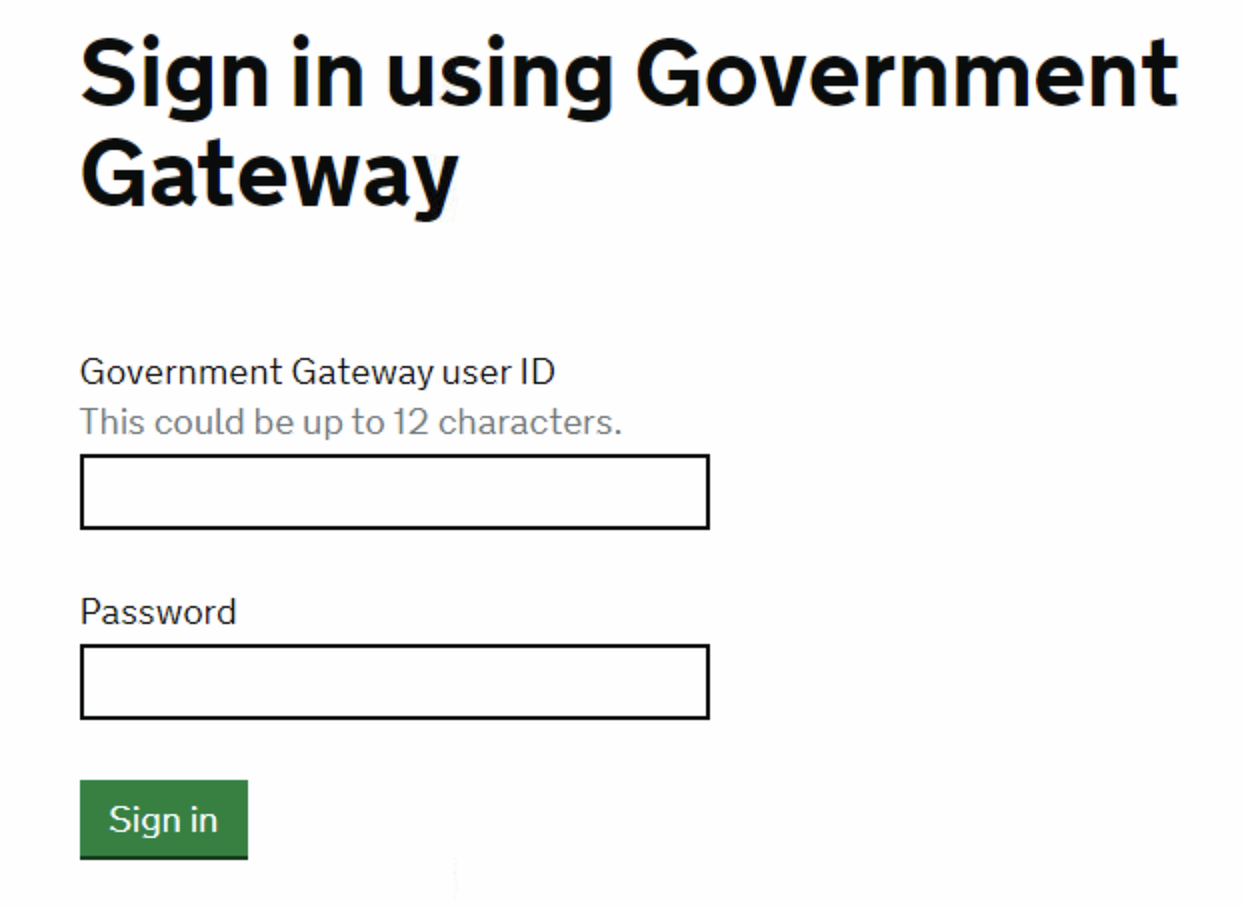

Sign in to your Government Gateway account.

If you don't already have a Government Gateway account for your business, you're able to setup one at this point.

You'll then be asked for your business details.

Depending on the type of your business, you'll be asked to enter in the details about it as per the 'Before you sign up..' section. Make sure you enter everything in correctly and double check before you proceed to avoid any issues later!

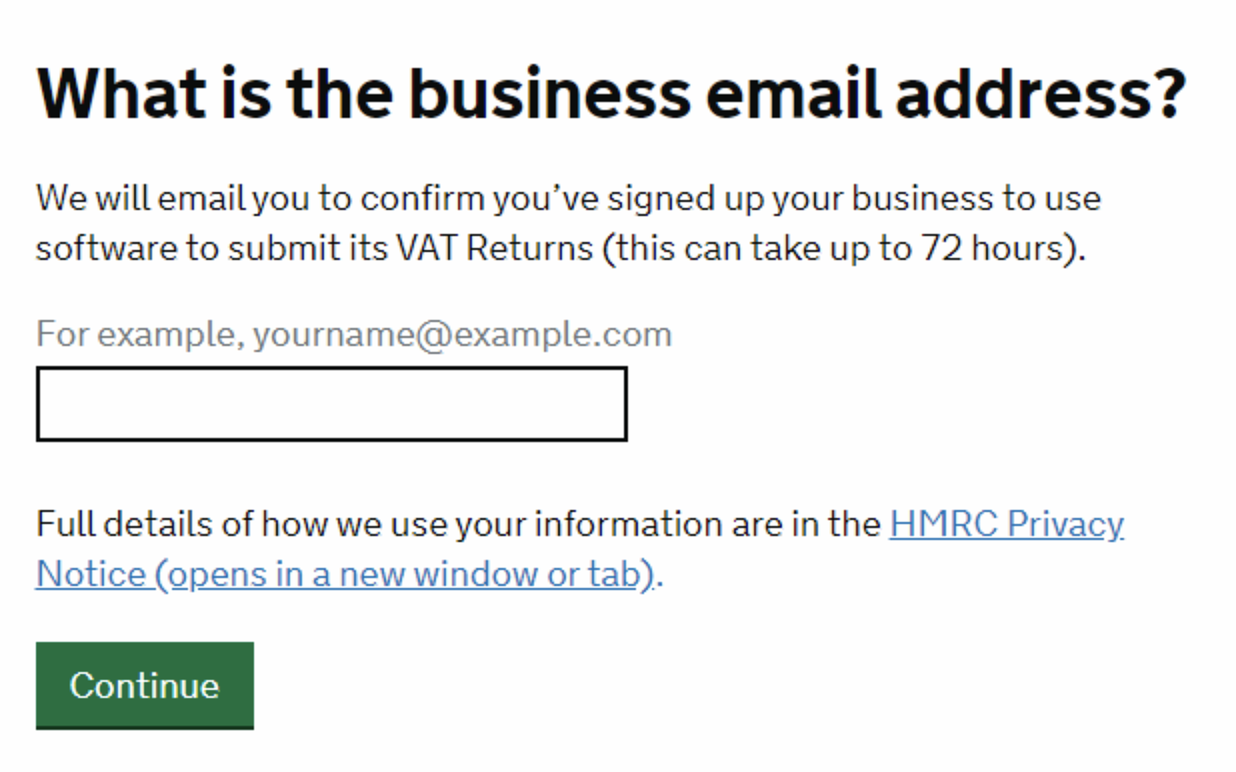

Enter your business email address.

This email address is used to confirm that you've signed up for Making Tax Digital for VAT. You may not get the email confirmation straight away as it can take up to 72 hours for this to be approved.

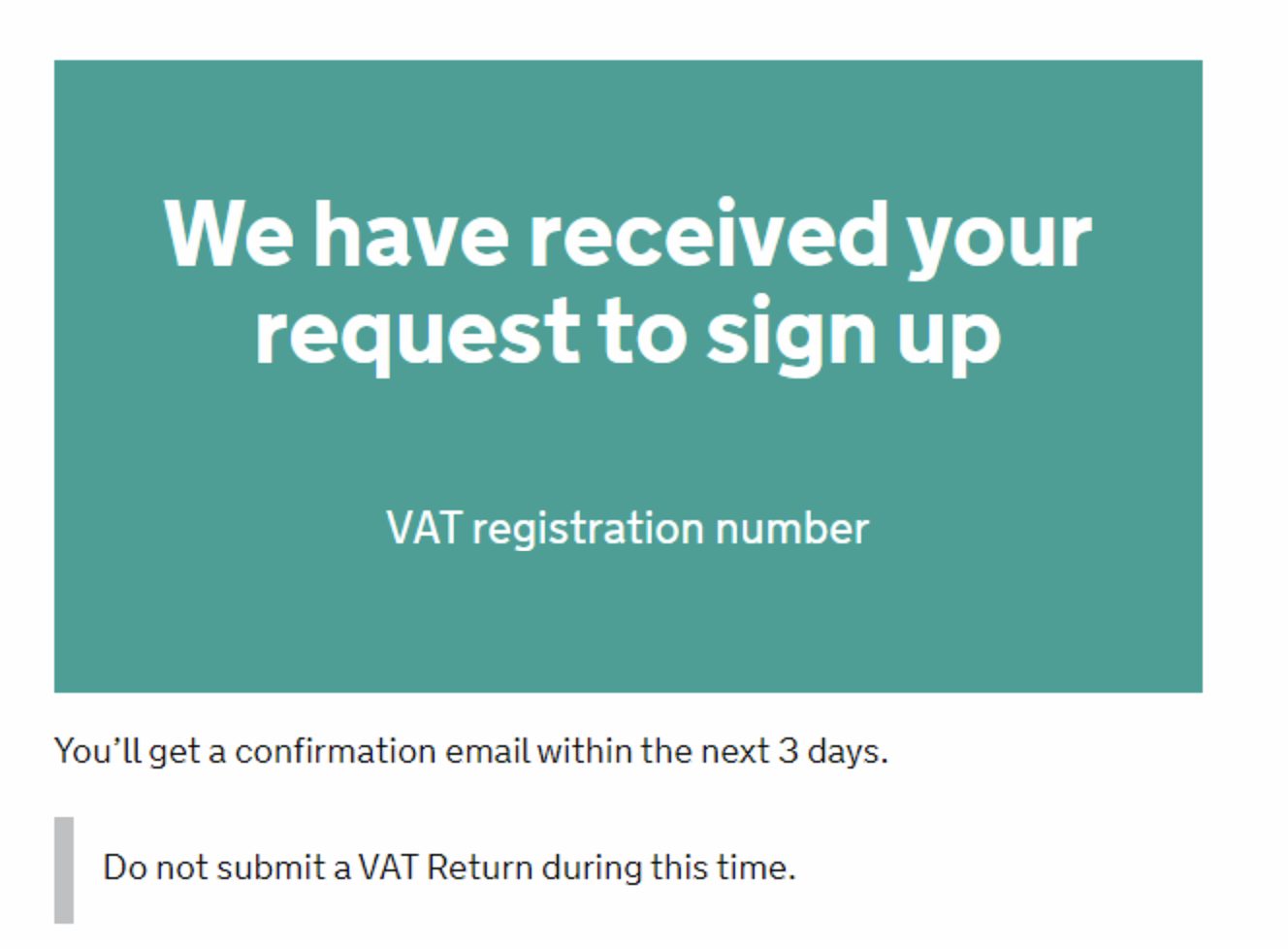

That's it! You're digital!

As mentioned in the previous step, HMRC will email you to confirm that you've been registered for Making Tax Digital for VAT.

In the mean time, you should not submit any further VAT Returns until you've received the confirmation email - you should also only use your new Making Tax Digital software provider, such as MTDsorted, to submit your VAT Returns from now on.

You can also start using your digital software to start tracking your income and expenditure, something MTDsorted is able to take on for you.