How can I link my Government Gateway account to MTDsorted?

Before we're able to access your HMRC details, you'll need to link MTDsorted to your Government Gateway account.

Navigate to your company configuration - this is found by clicking your company name in the top navigation.

Then click on the 'Government Gateway' tab.

If you've previously linked your Government Gateway account, you will see the option to relink or unlink.

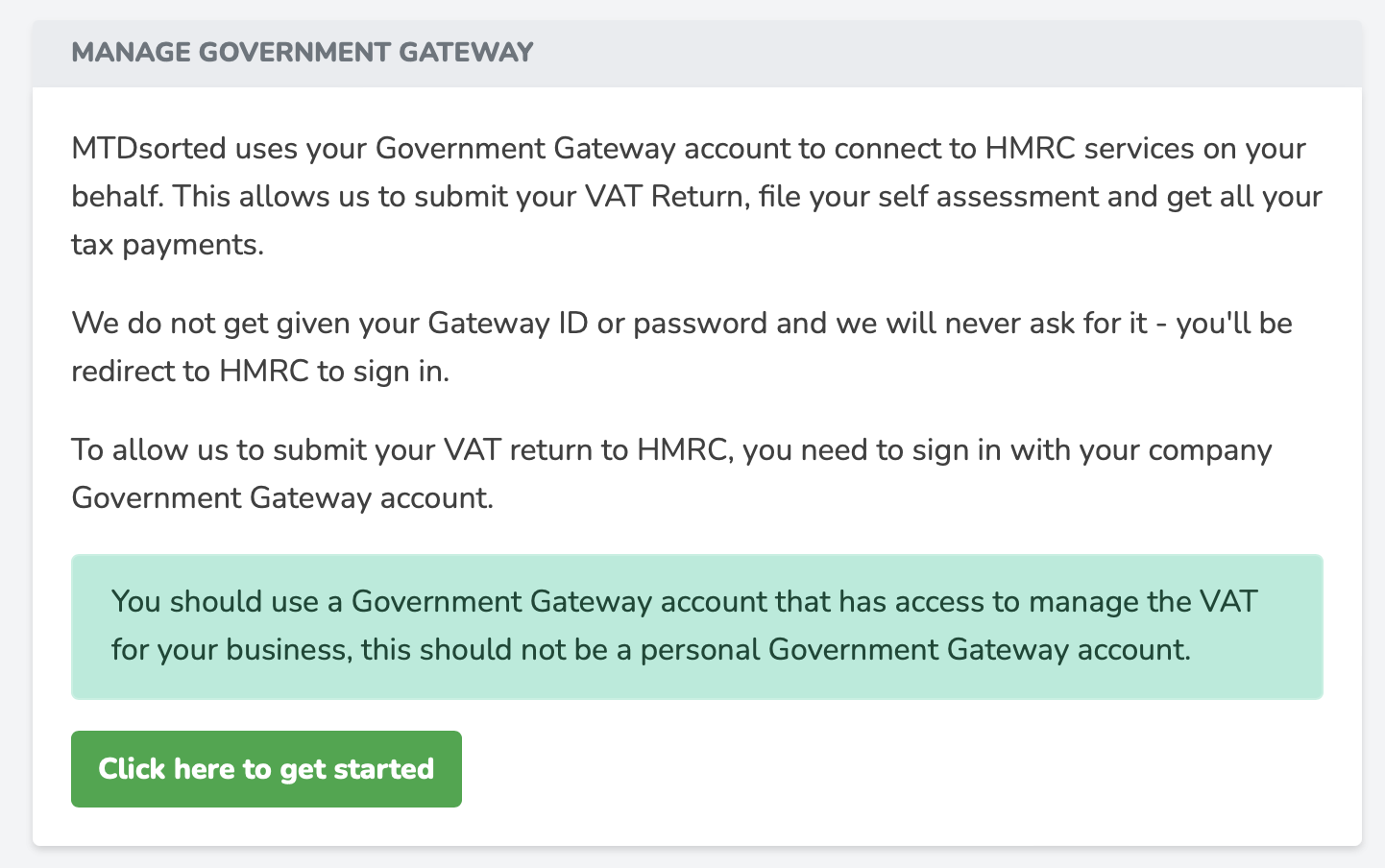

If you've not linked your Government Gateway or you've previously unlinked it, you'll see a 'Click here to get started' button.

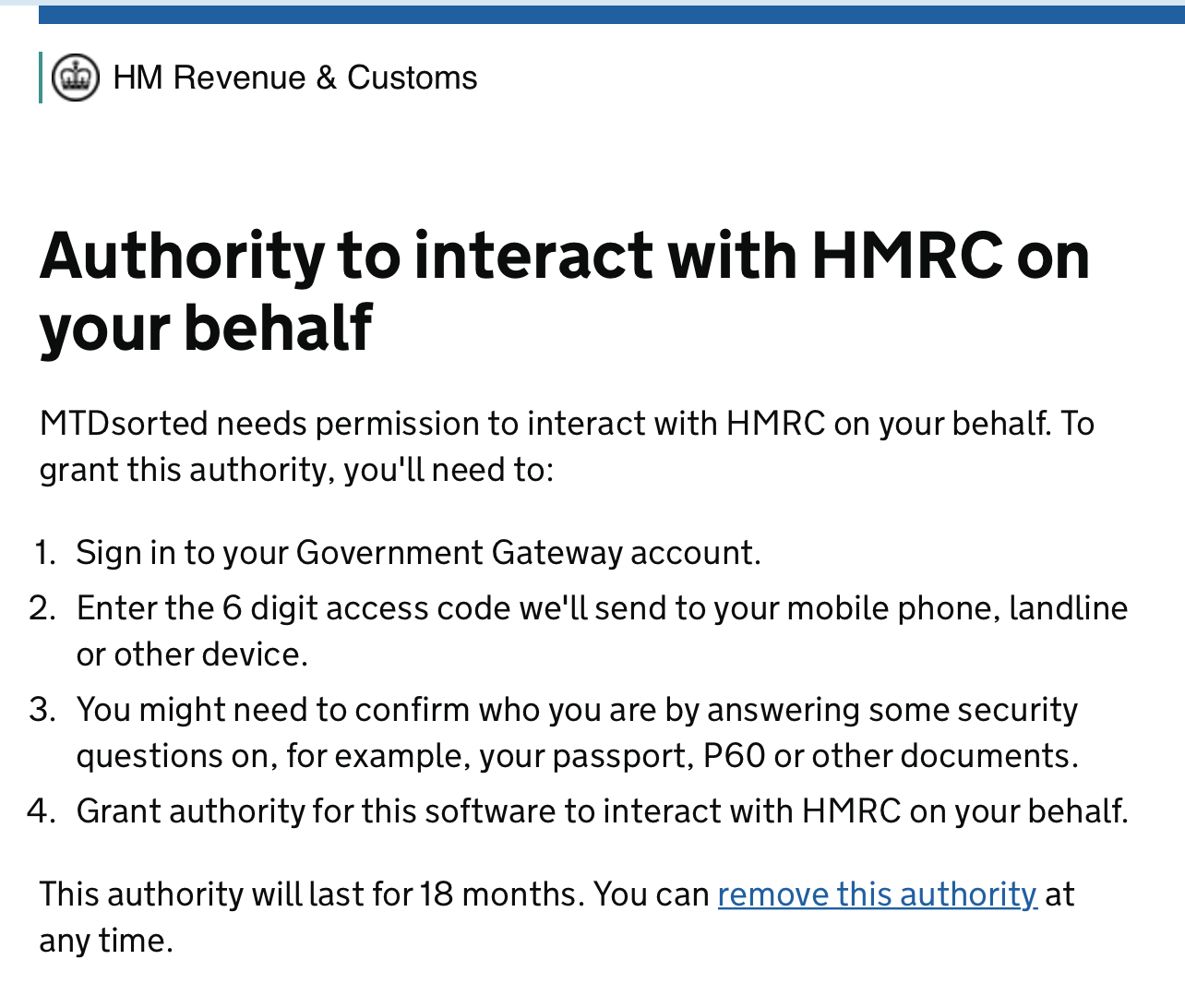

When clicking either the 'Relink Government Gateway' or 'Click here to get started' buttons, you'll be redirected to HMRC to sign in to your Government Gateway account.

By signin in to your Government Gateway account you'll give MTDsorted access to view your Tax and submit VAT Returns on your behalf - this will be valid for 18 months.

Once you've been redirected to MTDsorted from HMRC, we'll run a few checks on the link to make sure that the account is setup correctly.

The link can fail if:

- Your Government Gateway account does not match the VAT registration number, this means you'll see the 'CLIENT_OR_AGENT_NOT_AUTHORISED' error.

- Your Government Gateway details are incorrect or you're using a personal account that doesn't have permission to manage the VAT for your company.

- HMRC are undergoing maintenance or their systems are unavailable at the point you're linking.

We'll show you the reason why the link may have failed, and what you can do to resolve the issue.

If it's successful, you'll see a green tick and a message explaining the link was created successfully.

You'll need to make sure your VAT registration number has also been configured for your company. You'll find this in the 'VAT returns' tab in your company configuration.

Once both have setup, MTDsorted will automatically sync your VAT obligations and details from HMRC.

You're now ready to submit your VAT return!