Setting up your company

Once you've registered your account, you'll need to link your Government Gateway account and also provide us with your companies VAT registration number (VRN). We use these details to communicate with HMRC.

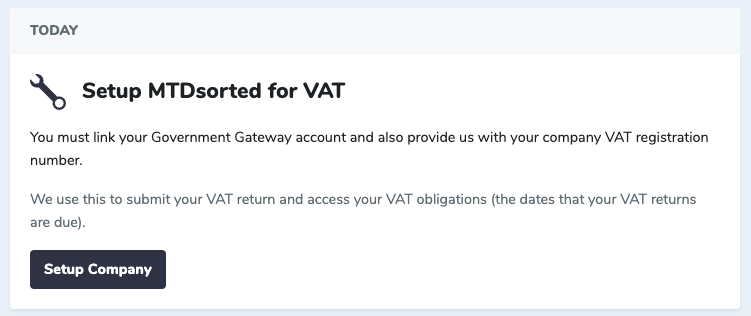

On your dashboard, you'll see a panel prompting you to 'Setup MTDsorted for VAT'. Click the 'Setup Company' button.

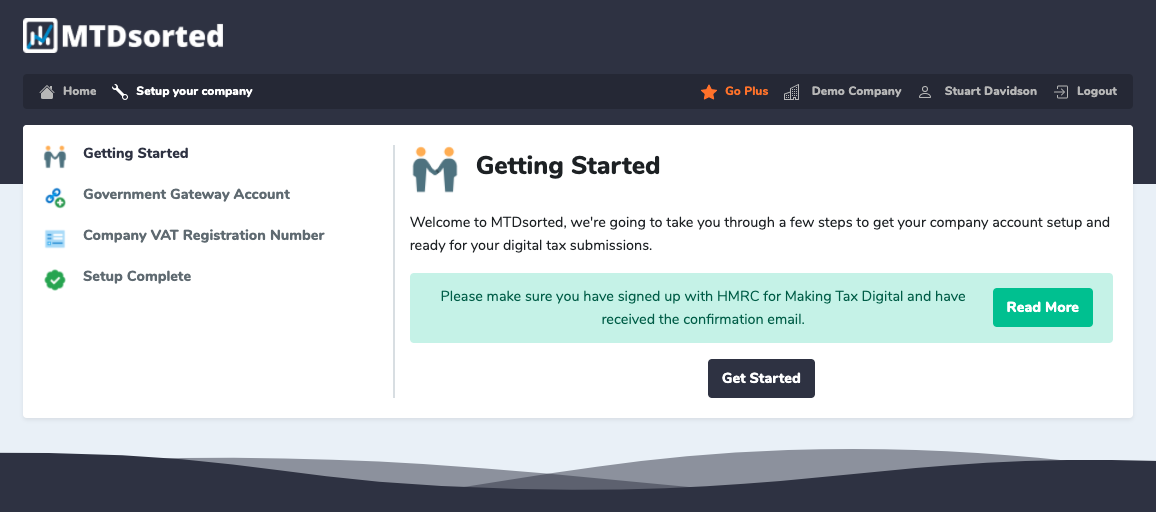

You'll then be taken to the setup page, this will guide you through everything you need to do to get your MTDsorted account up and running. When you're ready click 'Get Started'.

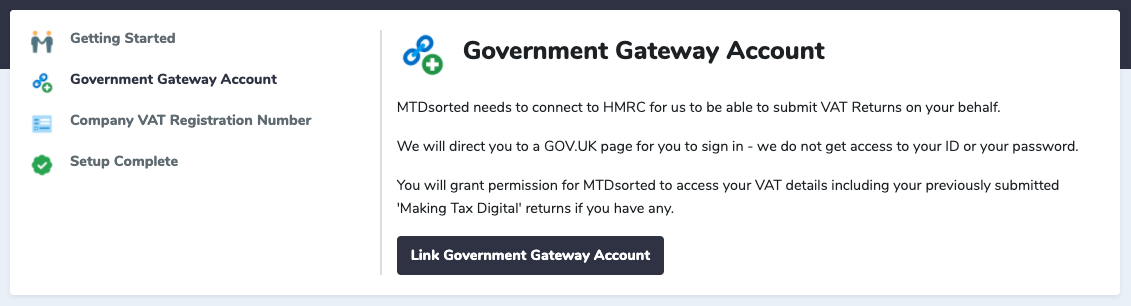

You'll then be guided to link your Government Gateway account - we use this to communicate with HMRC on your behalf, without it we cannot access your VAT information. By clicking the 'Link..' button, you'll be taken to HMRC to sign in.

The authorisation you provide lasts for 18 months however you can terminate this authority at any time.

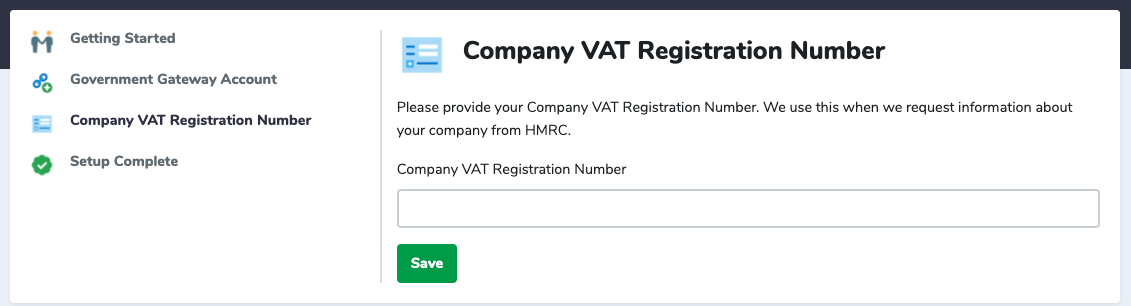

Once your Government Gateway account has been linked successfully, you'll be asked for your company VAT registration number (VRN).

We will check your VAT registration number at this point to determine if your account is ready to use 'Making Tax Digital'. If you've not yet received the confirmation email from HMRC, you won't be able to proceed past this step.

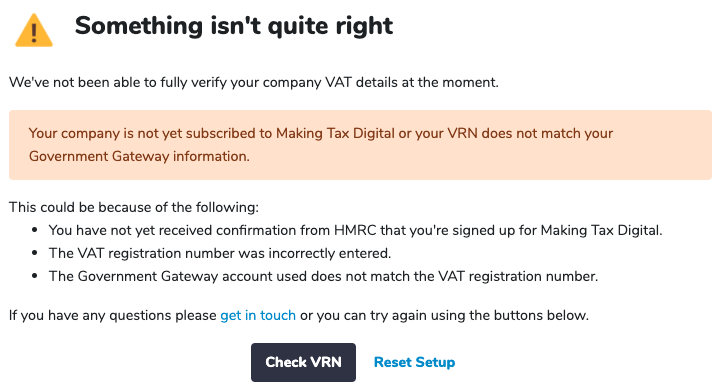

Should your VRN be incorrect or you're not quite ready for MTD, we will show you the following message allowing you to change your VRN or restart the setup.

You will be able to complete the setup at another time should you need too.

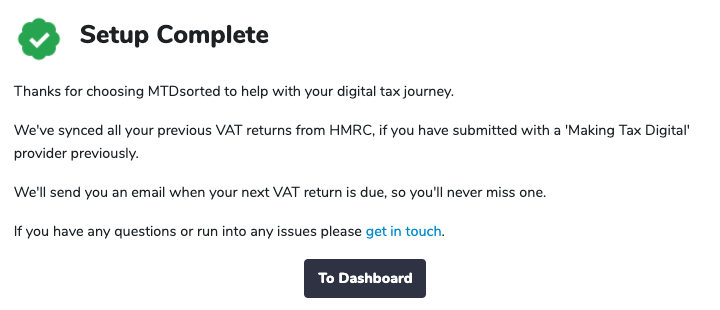

If your account setup is successful, you'll be shown the following message and you're ready to get started with MTDsorted.